Interest rate cuts in the US are slowly but surely coming. What does this mean for us and what can we expect from the financial markets?

First, we need to recap what has been happening in recent years and why interest rates have moved so quickly to relatively high levels compared to previous levels. It is safe to say that the current situation is the result of a pandemic in 2020. In order to save everything they could, the banks pumped roughly 20% to 30% more money into circulation than they had before the pandemic.

What is the consequence of pumping so much money into the system? Inflation. One of the most effective ways to tame it is to raise interest rates enough to cool the economy, and with it all inflationary pressures. Recall that inflation = debt, and that debt is created by new money in circulation. Raising interest rates = less debt availability, which leads to lower inflation and a cooling economy. A cooling economy means more people and companies will get into trouble, and once interest rates go down, those problems will be "solved" by delaying using new borrowing and another investment cycle.

Now, after a cycle of rising interest rates that caused a washout in the markets in 2022, we are in an environment that will experience the opposite. The main question is: How do we adapt to this interest rate cut cycle? Logically, cheaper money should be a good thing for everyone, which should mean that markets will remain in bullish mode. Theoretically, this reasoning is correct, and in combination with the presidential election, the statistics speak clearly in favor of this thesis. (During the period when the election was taking place and the markets were experiencing similar growth to now, the markets continued to grow at an average of 11% per year.)

There are, of course, many warning signs that tell us that all is not rosy and certainly not to be ignored. One of them may be the overvaluation of some stocks thanks to AI and the extreme concentration of the markets in just 7 select stocks, which are called the "Magnificent 7" on Wall Street. This situation is reminiscent of the period when the market then experienced a washout.

Then there is the interim problem of unrealised losses by the banks, who are now sitting and praying that interest rate cuts will come as soon as possible. Their assets are mainly in government bonds and fixed income assets from previous periods, such as mortgages and real estate. Due to the rapid rise in interest rates in recent years, these items may represent unrealised losses for banks. However, this situation can be resolved by lowering interest rates - if it comes in time.

Then there's the Japanese yen and the carry trade, which you can read about in one of our earlier articles.

Investing is often about mass psychology, so ask yourself - what did you start doing when banks here started cutting interest rates on their products, or companies started cutting interest rates on their bonds? How did you react, or how would you react if you had to make a decision now? You would probably start looking for alternatives to achieve at least the same, if not better, returns. That's now what awaits investors who are involved in the U.S. markets, which is, without exaggeration, the whole world. And since the U.S. is overwhelmingly used to being in the capital markets, they will look for alternatives there.

Investors will be looking for dividend-paying titles, defensive titles, and especially undervalued assets. That's why we've updated our portfolios:

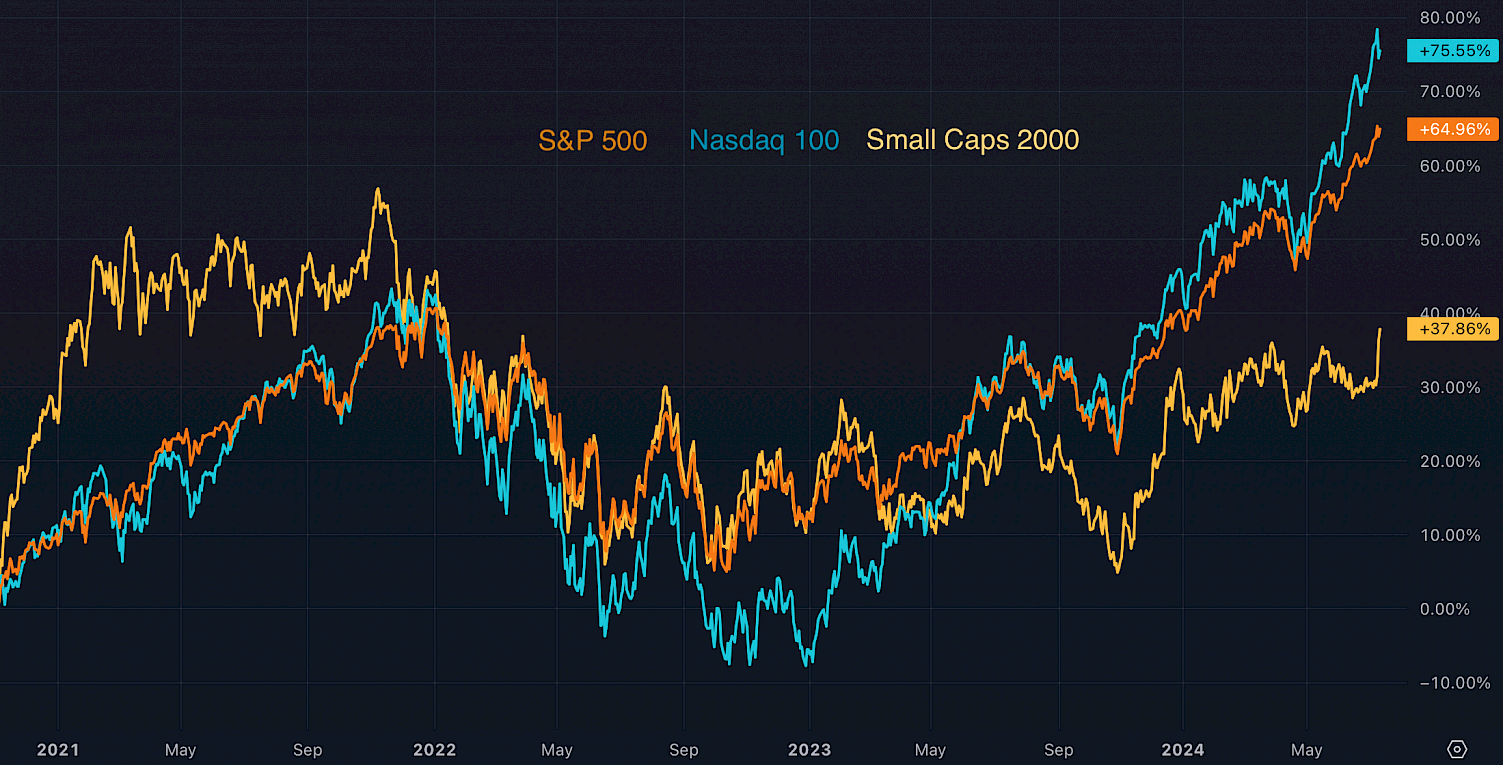

In recent years, these companies have been in an essentially perpetual bear trend and the divergence from major indices like the SP 500 and Nasdaq has been extreme. In a high interest rate environment, companies that have enough cash to survive anything have been better off, which Small Caps are not. But in an environment where interest rates go down, it may be that the stocks of these small companies find popularity with investors. These are not bad companies, just companies without much attention and seriously overpriced. That's why they seem to us to be one of the best current investments for the whole interest rate cut cycle.

Chart: S&P 500 vs. Nasdaq 100 vs. Small Caps 2000

The cheapest stocks in the market by P/E are currently energy and financials. Combined with above-average dividends and regular and steady growth, energy companies are interesting to us. In the technology sector, we are interested in current and potential trends such as uranium mining and geothermal energy.

In an environment of changing interest rates, bonds are one of the most value-sensitive assets. That's why we've incorporated a couple of bond ETFs that track bonds with maturities of more than 20 years. When interest rates fall, these bonds regularly gain in value.

Given current risks and geopolitical tensions, we have chosen to track precious metals as a hedge against unexpected events. In addition, we have noted the difference between the current valuations of gold and silver relative to the miners of these commodities. The miners appear to be very undervalued and many of these companies also pay solid dividend yields, which is consistent with our strategy.

Investing is always about finding a balance between risk and reward. While any market correction is unpleasant, it is also an essential part of long-term investing. Be cautious, but don't be afraid to look for opportunities where others overlook them.