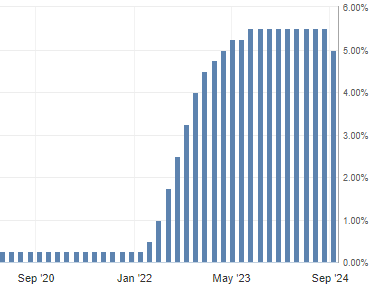

The Fed decided to cut rates by 50 basis points, starting a new economic cycle after four years of the steepest interest rate hikes in US history.

Four years after the inflation spike caused by factors like the Covid pandemic and the war in Ukraine, the US central bank had to tighten the spigots by raising interest rates rapidly. The aim was to tame inflation, but to do so the economy needed to slow down. And it was this move that brought the Fed to the dangerous edge between recession and a complete collapse of economic growth.

So far, data from the US economy does not suggest that a recession has already occurred, but a few warning signs are emerging, such as rising unemployment. However, history shows that similarly sharp interest rate cuts often herald recessions. The statistical data speaks clearly and even the Fed may assume that a recession is on the horizon, which is reflected in this significant 50 basis point rate cut.

However, the Fed is in a difficult position. It has to balance between not starting another wave of inflation, triggering a major recession or, in the worst case, plunging the economy into deflation. In addition, it must proceed with interest rate cuts in such a way that the market does not recognise that trouble is brewing.

There are currently differing views as to whether a 50-point cut indicates more serious problems. Some argue that it would be better to cut rates by just 25 points, while others consider 50 points to be the ideal step. In the end, the market will decide and its reaction will show how things really are.

At the moment, we expect at least a slightly positive reaction from the markets. However, the sensitivity to macroeconomic data will be extreme. The slightest signs of deterioration in economic indicators will be perceived by the markets much more negatively than before. The allocation of investments to precious metals and long-term bonds thus acts as a safety net.

It should also not be forgotten that this move may also have a political background. According to Donald Trump's statement, Jerome Powell, the Fed chairman, will lose his job if Trump comes to power again. Most Fed governors tend to lean Democratic, which could mean that their actions serve as lobbying for Kamala Harris and the current administration.

Whatever the case, the rate cut was inevitable anyway and this begins a new economic cycle for the next few years.