Is it a correction or just a rotation?

After a long period of growth, the market is finally showing signs of a correction, dominated mostly by technology stocks. Technology companies have experienced several years of strong growth, but a number of factors now suggest that this trend could be on the wane. One of the main reasons for this correction is the narrow focus on earnings. While technology companies have long had higher profits than other sectors, the gap is now beginning to narrow. As a result, investors are starting to look for opportunities in other, less overvalued sectors.

Another factor is the high level of interest rates, which could remain at higher levels for longer than expected. This could negatively impact technology stocks, which are sensitive to long-term interest rates.

The economic cycle also plays a role here. The current "recovery" phase has traditionally favored cyclical and value stocks over growth stocks such as technology companies. Moreover, as AI achieves greater market saturation, the long-term benefits could be more spread out beyond the technology sector.

Rotation into undervalued and smaller companies

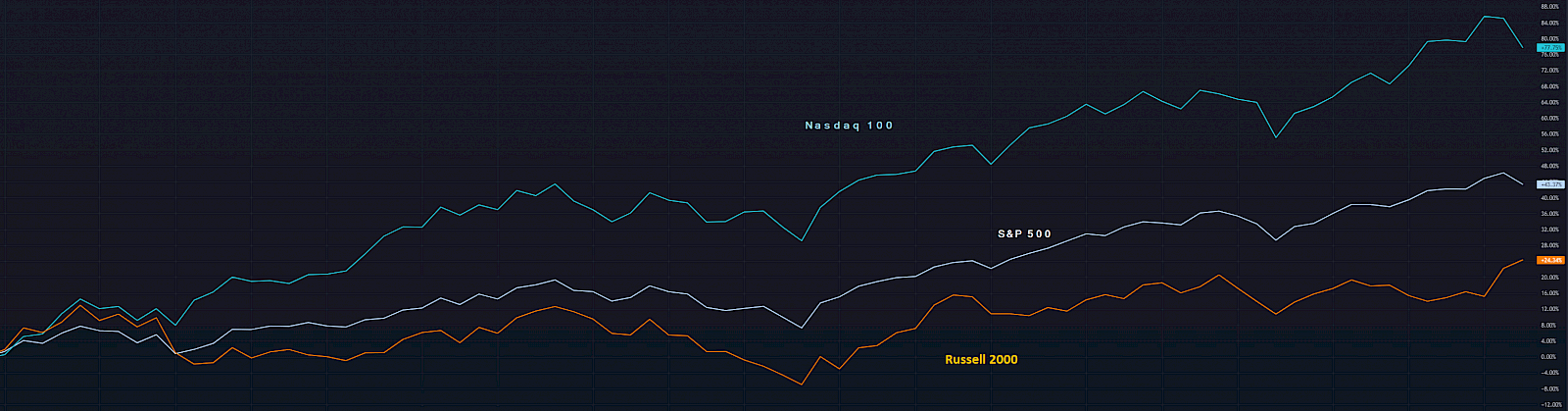

As we mentioned, investors are also beginning to shift their funds into smaller and undervalued companies. The Russell 2000 (a US index of smaller companies) has begun to see increased activity, suggesting that investors are looking for value outside of the big tech giants. This trend may present new opportunities for companies that have been overlooked.

August and the presidential election

Historically, August is one of the strongest months in the market during presidential elections. This effect may be due to increased activity and expectations associated with political changes, creating positive market sentiment. Currently, these are exactly the influences we are seeing - recent events such as the assassination of former President Donald Trump may also influence markets. Changes in political stability and uncertainty about future policy directions often lead to a more volatile market. Preference changes following such events can have a significant impact on investment decisions and market dynamics.

Our portfolio

However, in anticipation of a rotation or correction (which remains to be seen), we have prepared for these changes and have adjusted our portfolio somewhat. As a result, we have so far managed to outperform the S&P 500 index. Our strategy is to carefully select undervalued stocks and diversify our investments to minimize risk and maximize potential gains.

And how exactly? If you'd like a peek at our portfolio, feel free to drop us a line.