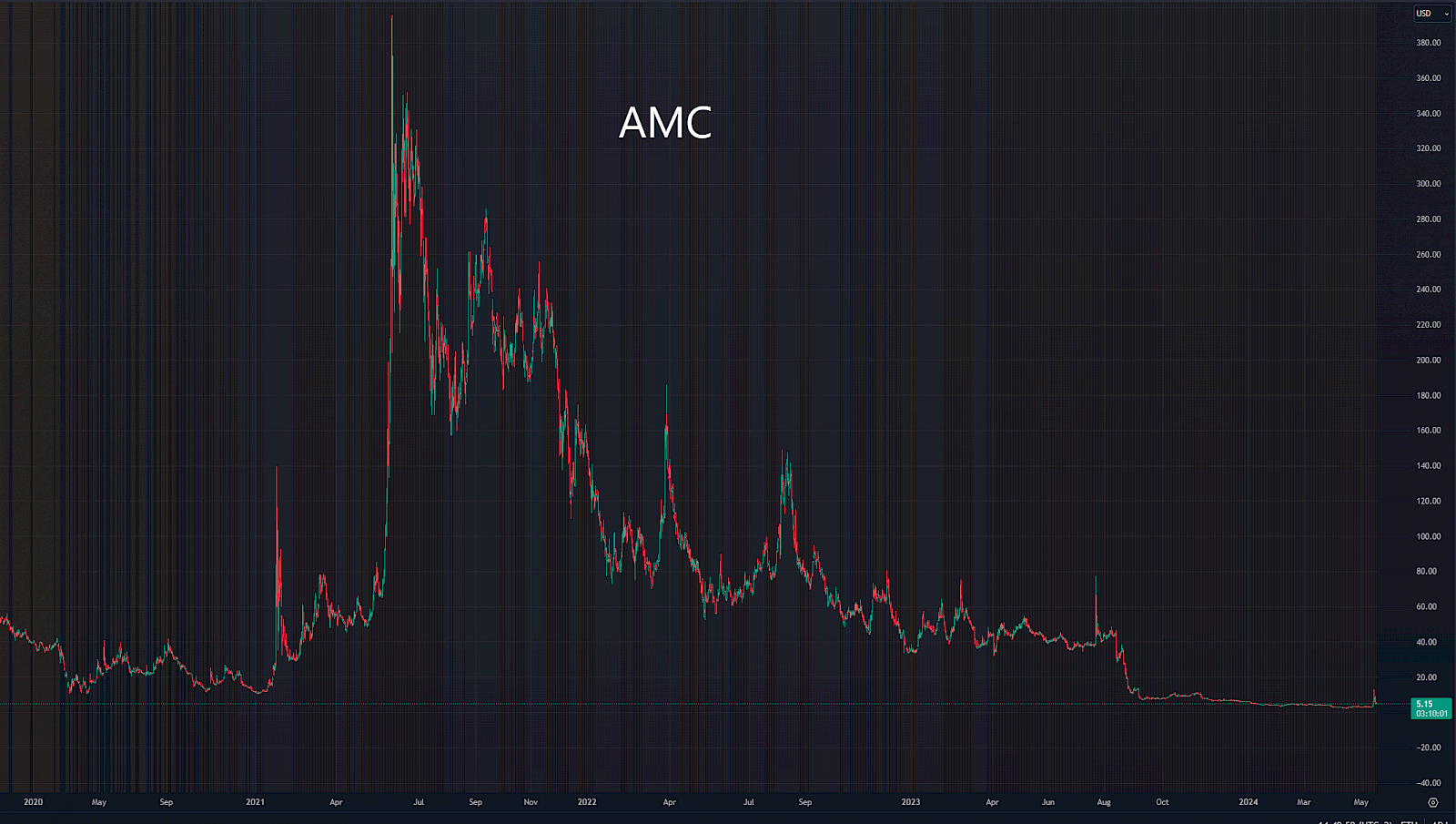

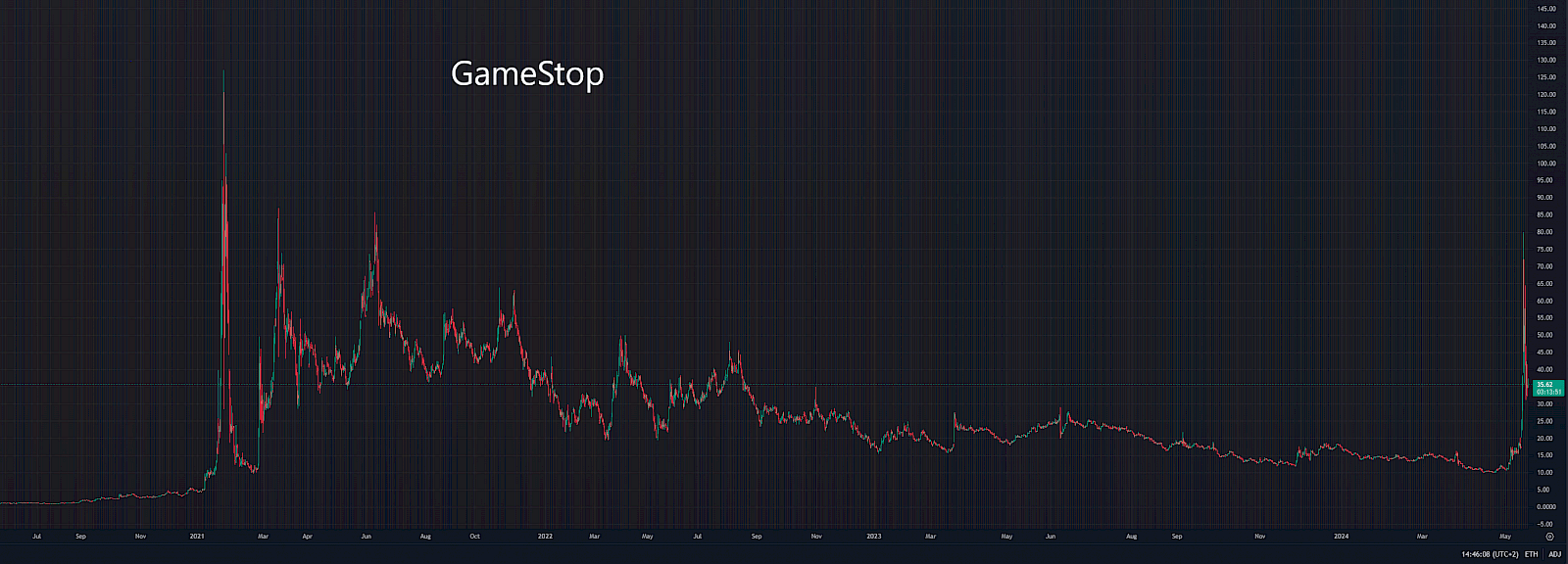

Investors seem to be turning their attention back to stocks like GameStop and AMC. This story began in 2021 when, after the COVID-19 pandemic, many people took to investing in the capital markets like a casino, spending the money the government provided them.

In 2021, stocks like GameStop and AMC experienced staggering increases. These stocks were massively "shorted" by hedge funds, and the community on the Reddit platform caused the so-called Short Squeeze.

What is a Short Squeeze?

First, it is important to understand what a short, or short position, is. It is a bet on a drop in the price of a stock. In practice, it means that you are borrowing shares to sell with the hope of buying them back later at a lower price. The difference between the selling and buying price then represents your profit or loss. You also often pay interest for borrowing shares.

The problem with "shorting" is that the maximum profit is 100% (only if the company goes bankrupt), but the potential loss can be unlimited, which is a significant risk. The Risk : Reward ratio is 1:1, which is very risky for traders and almost equivalent to a bet on roulette. Therefore, long term shorting of the market is ineffective.

Knowing what a short is, we can look at the Short Squeeze.

Imagine you are in a short position at a price of $6 per share. If the share price rises to $12, your loss is 100%, forcing you to exit the position. This creates a buy order in the market at $12, further increasing demand and pushing the price up. At that point, there is a rapid rise in the stock price as investors who were shorting have to close their positions and buy shares at rising prices.

Simply put, the more money there is in short positions, the greater the potential short squeeze.

In the case of AMC and GameStop, what happened was that large hedge funds had huge short positions. When thousands of small Reddit investors started buying these stocks, the price skyrocketed. Once the broader public noticed, they started buying as well, forcing the big players to exit their short positions so they wouldn't lose all their money. These stocks thus achieved a multi-fold increase, which was described as a victory for small retail investors over the big hedge funds. One of the key figures in this movement was a user known as "Roaring Kitty".

Unfortunately, in the end, many ordinary people who tried to make money in the stock market suffered significant losses.

Now, after three years of inactivity, the "Roaring Kitty" account has unexpectedly woken up and many people believe that the situation of 2021 will be repeated. In the first two days of trading for this stock, the scenario seems to be similar. However, it's important to remember that this fight may leave many people out of pocket again, and this time it won't be hedge funds. Therefore, we would like to warn anyone who thinks of participating in this ride, the chances of winning are very slim.