NVIDIA.

In recent years, we have seen many extremes that were previously unimaginable. Perhaps it all started with the arrival of Covid in 2020. Since then, we have seen many things in the markets that often don't make sense. This article, however, focuses on Nvidia stock.

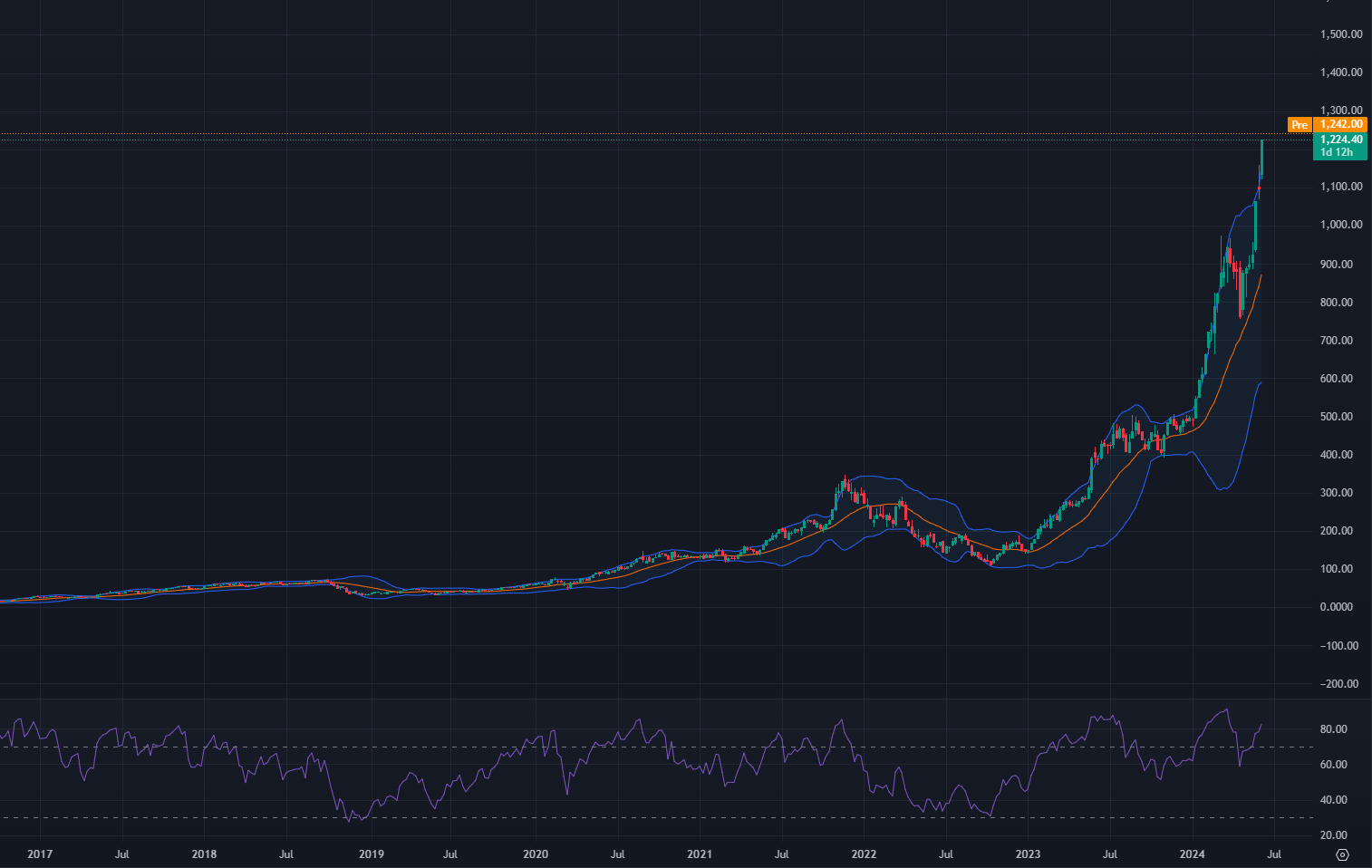

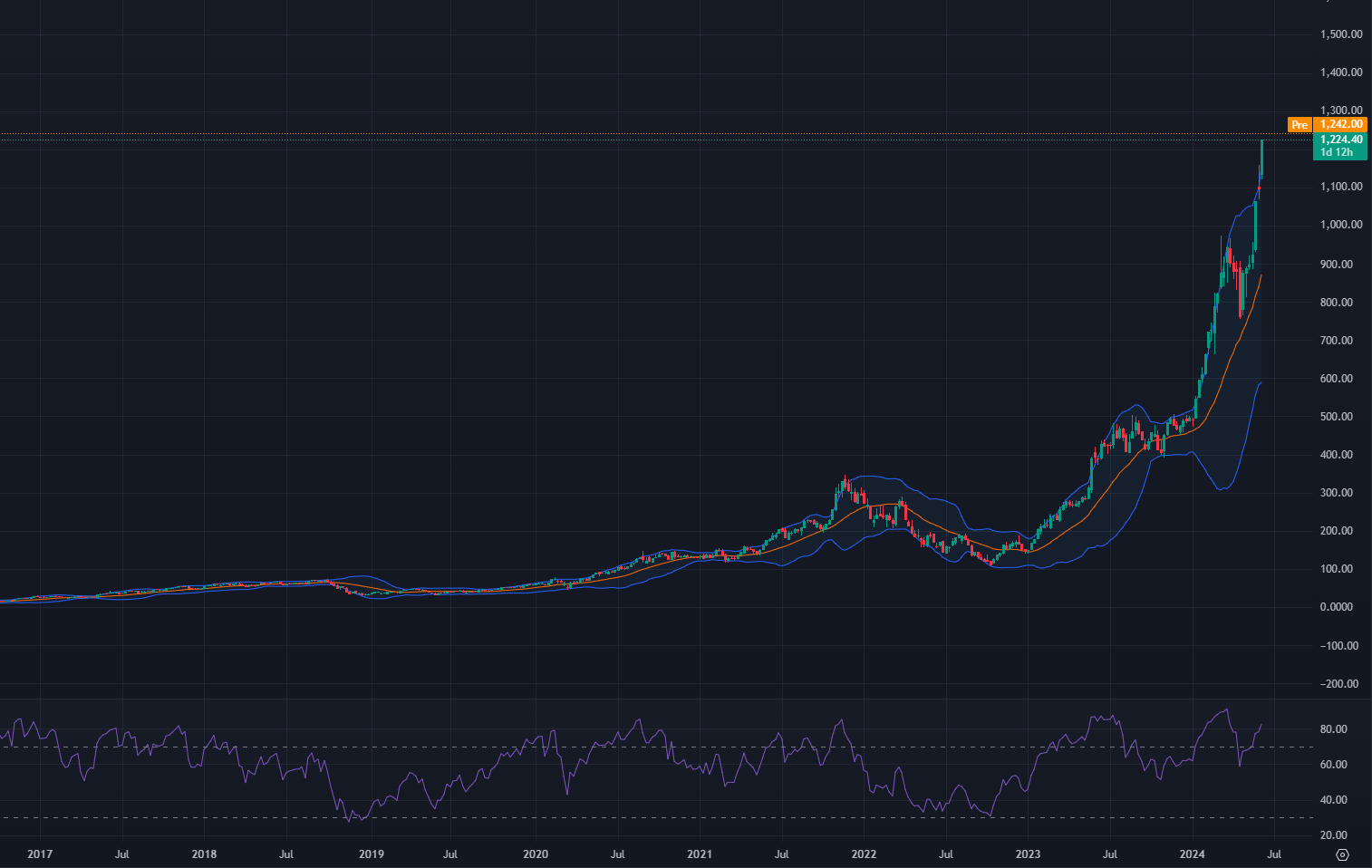

The value of Nvidia stock was not a surprise to us as it was around $400-500 per share. Since then, however, we have been constantly haunted by the feeling that the current situation is simply overblown. Currently, the value of one share is around USD 1200. Nvidia has seen an increase of a whopping approx. 1000% since 2020. Certainly, this is a revolution driven by artificial intelligence and the mania around it. The potential of this technology is immeasurable at the moment - no one knows what its impact will be or how much value it will have in the future. So we are in one big speculation that more and more investors are getting into.

The word 'bubble' might come to mind. We'd hate to go down that road, but no one really knows what the future holds for AI and Nvidia. Comparisons to the internet revolution of 2000-2001 are often made. What happened after that, before the companies that dragged that revolution out for years to come crystallized, you can certainly find for yourself under the Dot-Com Bubble.

Is Nvidia's story similar to that of Cisco Systems in the Dot Com Bubble? Maybe yes, maybe no. Let's take a look at the similarities.

Cisco Systems in 2000-2001

- The company focused on improving network infrastructure and supporting the growth of the Internet.

- In the period before the dot-com bubble burst (1999-2000), Cisco was experiencing tremendous growth due to the demand for Internet infrastructure. It was a key supplier of networking equipment to the growing Internet market.

- In March 2000, Cisco became the most valuable company in the world with a market capitalization of over $500 billion.

Chart: Cisco System in 2001 (Bollinger Bands)

Nvidia in 2024

- Nvidia is experiencing tremendous growth due to its dominance in graphics cards and AI technologies. It has established itself as a leader in computing technologies for AI, gaming and data centers.

- In 2024, Nvidia reported record revenue and significant profit growth due to strong demand for their products, becoming the second largest company by market capitalization, surpassing $3 trillion.

In this respect, these scenarios are quite similar. Both companies are facing a revolution that is shaping the future (Internet vs. AI). However, Nvidia has the upper hand thanks to the diversification of its product portfolio. While its biggest revenue comes from data centers, this diversification can help keep its value at relatively attractive numbers even in the event of a shakeout, and so Nvidia could once again become an attractive investment.

Chart: Nvidia in 2024 (Bollinger Bands)

What now?

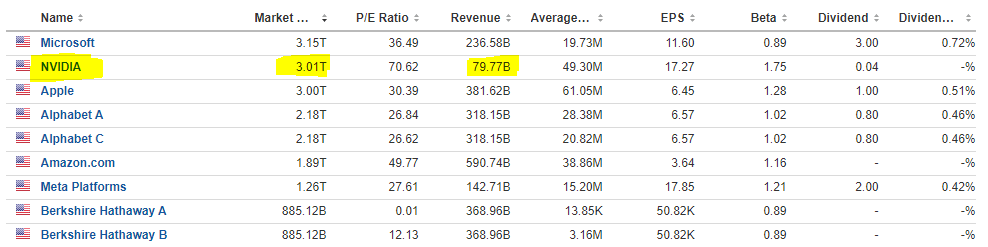

According to ratios such as P/E, P/CF, P/B (Price/Earnings, Price/Cash Flow, Price/Book Value), the stock is very expensive. Further, we find the earnings of $79.77 billion inadequate to invest compared to other similarly sized companies.

There are many scenarios of how the stock may evolve. There are also many risks that are now prevalent and therefore no longer make sense for us as an investment. We have reduced the positions we had a lot and we will slowly let it flow without us, we will see again in the future. However, Nvidia may meet or exceed expectations and its valuation may be higher than we now imagine - indeed, it has shown this for many months in a row.