Tesla.

Tesla is active in several major segments:

1. Electric Vehicle Manufacturing - Tesla manufactures various models of electric vehicles, including the Model S, Model 3, Model X, and Model Y. Tesla is also preparing new models such as the Cybertruck and Tesla Semi, and they are also sure to come out with a new Roadster model soon.

2. Energy - Tesla manufactures and sells energy products such as solar panels and roofing, as well as Powerwall, Powerpack and Megapack battery energy storage.

3. Autonomous driving and software - Tesla is developing autonomous driving software, known as Full Self-Driving (FSD). This technology is constantly improving and is one of the key elements of Tesla's vision for the future of transportation.

4. Charging Infrastructure - Tesla has built an extensive network of Supercharger charging stations around the world, enabling fast charging of Tesla vehicles.

As well as Optimus Tesla robots

Tesla is investing heavily in the development of robots, particularly the humanoid robot known as Tesla Bot or Optimus. This robot is designed to perform repetitive or dangerous tasks, thus having the potential to improve efficiency in industrial and domestic environments. Optimus is equipped with advanced artificial intelligence and sensors that allow it to interact with its environment and perform complex tasks. This project is part of Tesla's broader plan to use artificial intelligence not only in transportation, but in other areas of human life. But we'll get to Optimus in a moment. I'd like to say a few more words about Cathie Wood and her ARK Invest.

Cathie Wood and her investment company ARK Invest continue to see huge potential in Tesla. Despite recent share price declines and concerns about possible missed delivery volume targets in the first quarter of 2024, ARK Invest is actively buying Tesla stock. In March 2024 alone, ARK Invest purchased $35.21 million worth of Tesla stock. This purchase was split between three of their funds: the ARK Innovation ETF (ARKK), the ARK Autonomous Technology & Robotics ETF (ARKQ), and the ARK Next Generation Internet ETF (ARKW), noting that we have some of these ETFs in our portfolio as well.

Cathie Wood believes Tesla stock could reach as high as $2,000 per share by 2027. Her optimistic outlook is based on the expectation that Tesla will dominate the market for autonomous vehicles and other technological innovations. The ARK model assumes that Tesla will be able to finance its future factories and investments without the need for a significant capital raise.

In addition, ARK Invest does not include in its short-term models the significant contribution from projects such as the humanoid robot Optimus, although in the long term it expects that these technologies could contribute significantly to the value of the company.

With Tesla, you really need to remember that it's not a car company. Its scope is much broader, which is why the focus should now be on the latest developments at Tesla, where there was a vote on Elon Musk wanting USD 54 billion from Tesla to develop the humanoid robot Optimus.

The approval process for this investment involved intense discussions at the Tesla board level and also required approval from the company's major shareholders. The move is part of Tesla's broader strategy to diversify its technology portfolio and expand into new areas beyond traditional electric vehicle manufacturing.

Elon's plan has been approved and the $54 billion investment for the Optimus humanoid robot project can begin. This massive funding will come primarily from Tesla's internal resources, including capital raised from recent earnings and stock sales. Musk said that this investment will be used to accelerate the development and production of the Optimus robot, with the goal of starting mass production and deliveries by 2025.

The humanoid Optimus robot is designed to perform repetitive and dangerous tasks, both in industrial and domestic environments. Optimus is equipped with advanced artificial intelligence and machine learning algorithms that enable it to autonomously navigate and interact with its environment. The robot is capable of performing tasks such as lifting heavy objects and manipulating various objects, which has the potential to significantly improve work efficiency.

Elon Musk believes that Optimus could be one of Tesla's most important products, with the potential to surpass all of the company's existing products, including electric cars. Despite the sceptical views of some experts who point to the technical and practical challenges associated with developing humanoid robots, Musk remains optimistic and predicts that Optimus will play a key role in the future of technological innovation.

It is Optimus that has given us pause for thought as to whether it is the piece to the Tesla puzzle and the very reason to allocate part of the portfolio to Tesla. If we were to talk on the level that Tesla is purely a car company, it would still be a non-investable stock for us. Of course, sometimes you have to look around the corner and from a distance for greater context.

At the moment, a couple of quarters is a pretty likely scenario for Tesla shareholders, which actually can already be seen as it is the only one of the "Magnificent 7" stocks to be down about 26% year-to-date. Further, consider the $54 billion number, which actually amounts to 10% of Tesla's capitalization, so further downward pressure on the price can be expected.

So what's the so strong argument for allocating part of the portfolio there?

Tesla is already a profitable company after many years of four consecutive years, but still valuationally expensive, its only value is its hypothetical future. However, it has to be said, if we go back in history and look at its evolution and Elon Musk, there is a certain systematicity, and the fact that Musk promises something, doesn't deliver for a long time, and then finally delivers what he promises, but with a delay, that's why Tesla has always had a roller coaster ride on its stock, but I stick to the one motto on this one, he who laughs last laughs best.

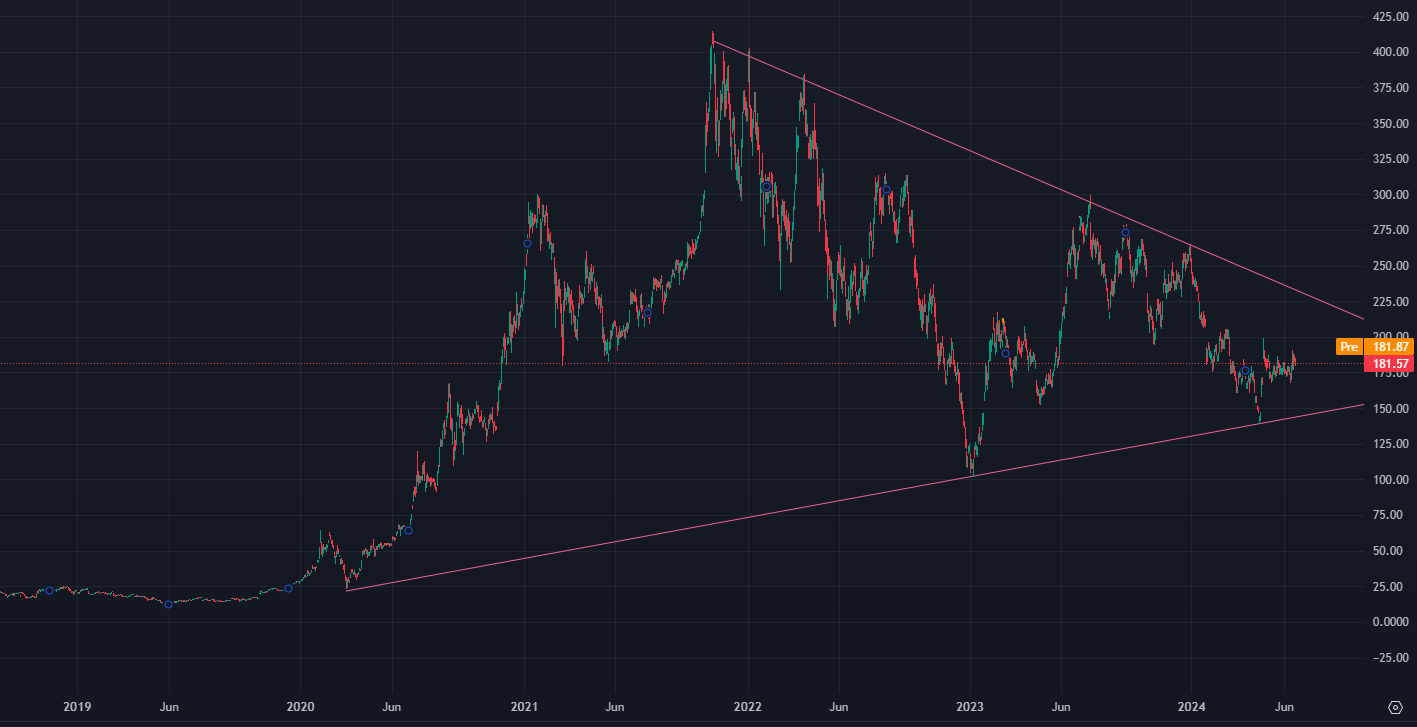

However, we are preparing a position where according to the chart. see above, we can see we are somewhere in the middle from a bigger move between support and resistance lines, plus we are also preparing for when the big mania in AI cools down, then we can expect better prices all around.

Another such hidden and mainly psychological argument is the Tesla Roadster, the first version which is from 2007 sells for around $100-200k. But when the new model is mass produced, one can expect more demand for Tesla stock.

Disclaimer:

This article is provided for informational purposes only and should not be considered investment advice, a recommendation to buy or sell securities or any other financial products. The authors make no representations as to the accuracy, completeness or timeliness of the information contained in this article. Readers should consult a financial advisor or other professional if they need specific investment advice or if they have questions about their financial decisions. The authors of this article are not responsible for any loss or damage caused by the use of the information in this article. Past years' profits are no guarantee of future profits.