The biggest show is in Japan

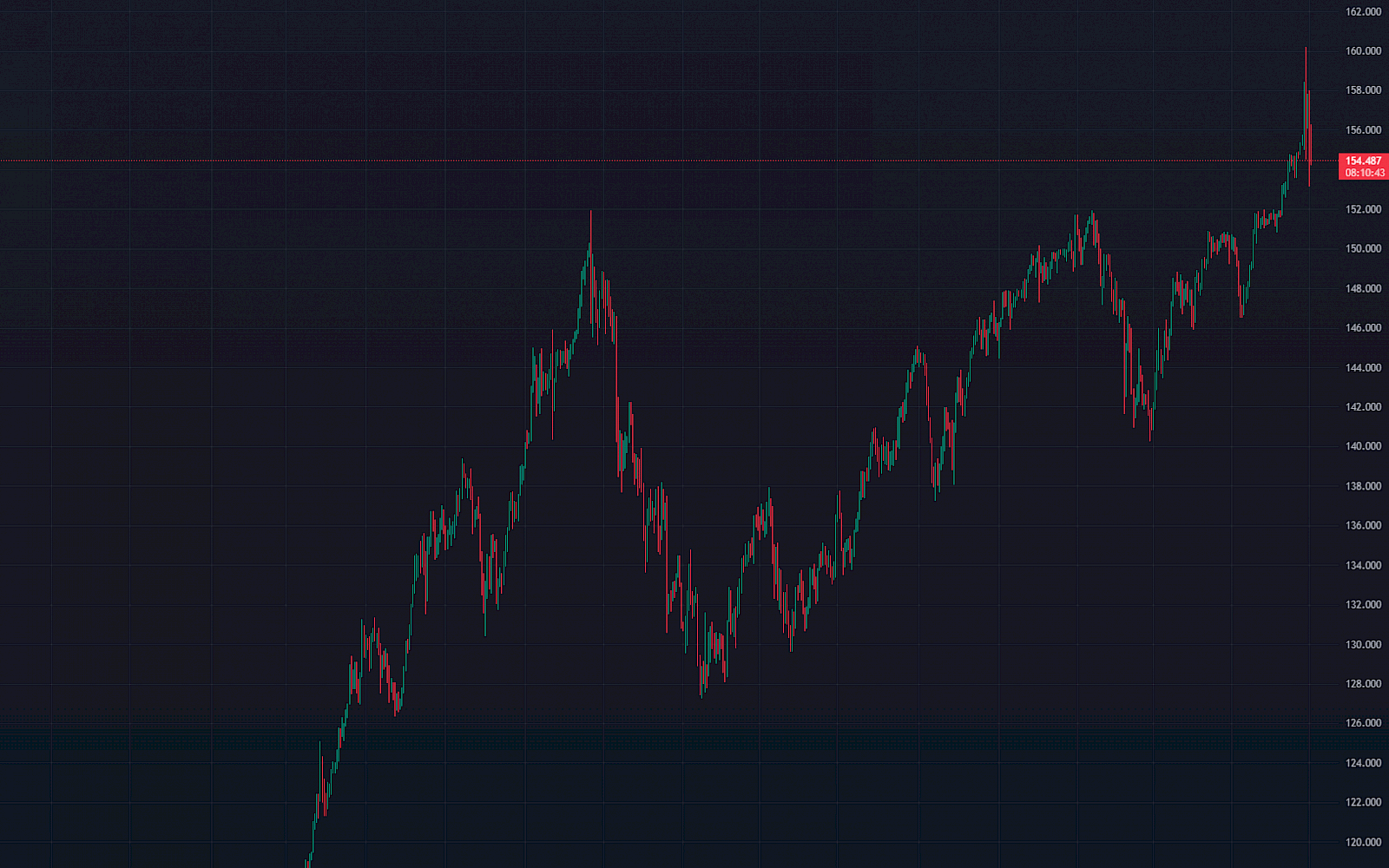

The last few days in Japan have really been worth it and the events that are happening there could have a real impact on the global economy. The central bank of Japan (hereafter referred to as the BOJ) has intervened heavily to stop its currency from falling. With the USD/JPY currency pair as high as 160 yen per dollar, the BOJ took the helm and strengthened its currency by about 3.5%. Two days later, however, it intervened again, with a slide from 158 USD/JPY to 153 points, or something around 3%. One can expect that in this way the BOJ made it clear to everyone that no one should go against it.

But why is this important? As we've written a few times, Japan holds a lot of US debt, and in turn many institutions have borrowed money from Japan at zero interest. Simply put: debt = new money = inflation. But if your currency loses half of its value in 5 years, it helps inflation and if the economy doesn't grow = stagflation. And that's not a situation any country wants to get into.

So what is the solution?

Chart: USDJPY

This is to follow up on the escalation of the war in the Middle East

Many investors think that stocks have experienced declines due to the escalation of the war between Israel and Iran, but this is only partly true.

Remember when the CNB intervened to help exporters? A weak currency for exports is a great thing. But for imports? And Japan has to import oil, which again means an extremely uncomfortable situation for the Japanese that would put them in a dead end and we get to the scenarios described above.

Fortunately, the people in the US government are very aware of this and have managed to reassure the Israelis so that "almost" nothing has happened.

April was the first red month in six months.

Finally we come to the state of the markets by the numbers. There was a slight correction in April for the very reasons mentioned in the article above. The S&P weakened by 1.9% and the Nasdaq 100 by 4.22%. So, just small numbers so far and we'll see how it looks going forward. We believe we could see some more declines.

April is in the spirit of earnings season, which so far has been rather kind of neutral. When Meta Platforms, for example, showed stronger than expected numbers, but the stock fell about 12%. Or conversely, Tesla, which showed that they are a stock you can't rationally invest in based on the numbers. But after the results, a 13% increase.

Something else to add on that April, May 1 was the Fed meeting and we didn't hear anything particularly new. Except perhaps that the Fed decided to provide more liquidity to the market than expected. Which the market took quite positively at first, helping the indices into more green numbers, but after the press conference ended, stocks decided to take back the gains.

Something else to add on that April, May 1 was the Fed meeting and we didn't hear anything particularly new. Except perhaps that the Fed decided to provide more liquidity to the market than expected. Which the market took quite positively at first, helping the indices into more green numbers, but after the press conference ended, stocks decided to take back the gains.

How are we handling all this in our country?

For now, we are exactly between the two points where we would like to strengthen our positions, all the selling is just a way to make more money in the future. However, if the market switches back into a more positive mode, and the selloffs do not take place, we will not hesitate. The only thing is, we have reduced our positions around technology slightly and have cash ready for other opportunities. We are also preparing to buy companies that could shine in the months and years ahead.