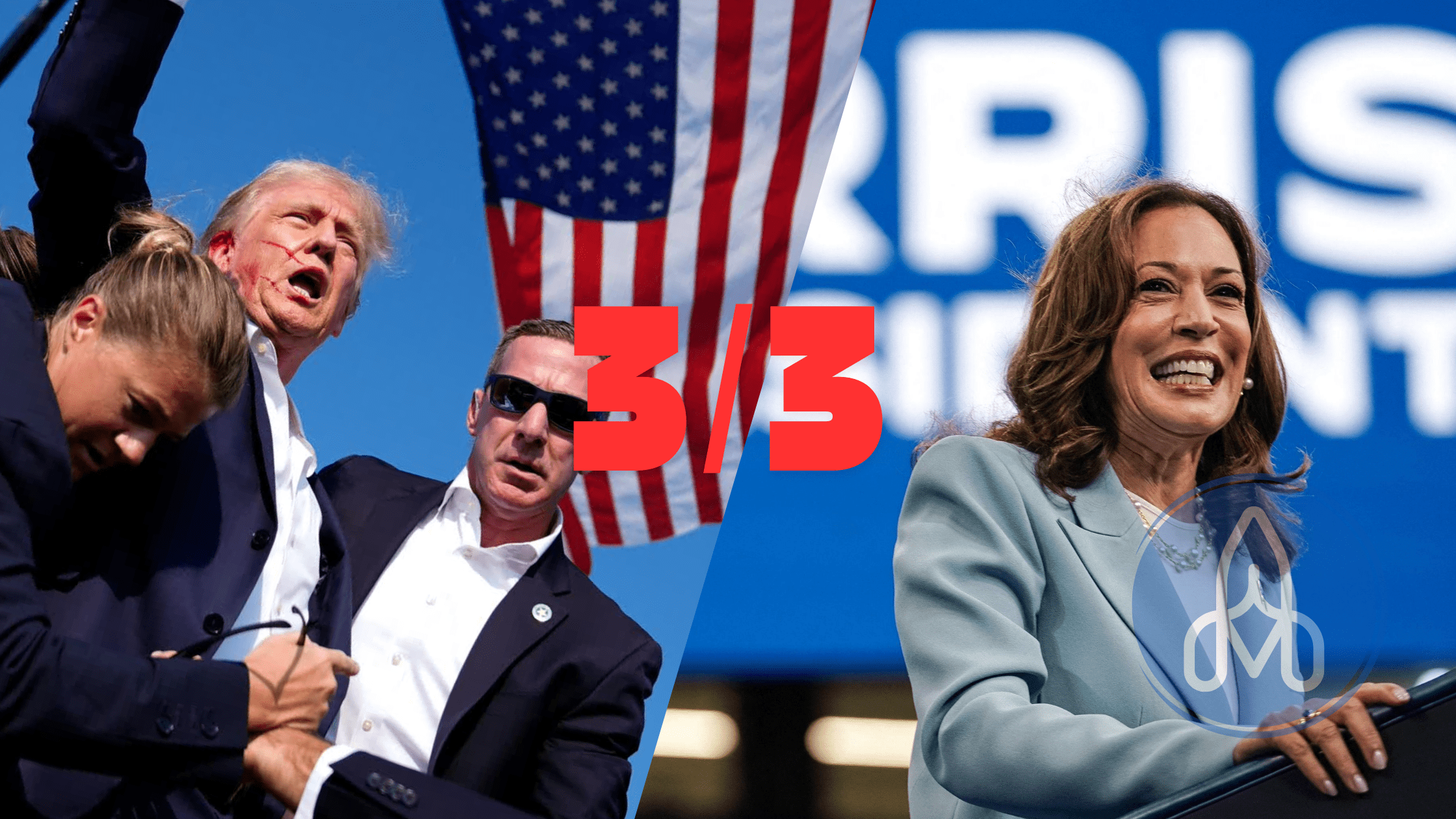

Strategies for the election of Donald Trump

With the election looming, we have raised cash in advance to be ready to react quickly to the results. If Donald Trump is re-elected, we have a plan in place that targets companies with U.S. headquarters and operations. Below are the specific steps we plan to take:

- Jacobs Solutions (J):

- Reason: We expect sentiment toward infrastructure projects to strengthen as the Trump administration has traditionally supported domestic construction and infrastructure upgrades.

- Action: As a new addition to the portfolio, Jacobs Solutions is our choice because of its focus on domestic projects and attractive valuation. J is a company with a good dividend yield and currently a very attractive valuation.

- Verizon (VZ):

- Reason: VZ is a stable and high-value company in the telecom sector with operations focused exclusively on the US. We expect Trump's pro-American policies to bring domestic focus and support to telecom and infrastructure companies.

- Action: we will be raising positions as VZ's market valuation has declined in recent days, opening up a better entry position. In addition, VZ offers a solid dividend yield.

- iShares Russell 2000 ETF (IWM):

- Reason: Small U.S. companies should benefit significantly from Trump's approach to deregulation and domestic economic policy.

- Action: We plan to increase positions in this ETF because we believe smaller companies will have growth opportunities under a less regulated environment.

- Chevron (CVX) and ExxonMobil (XOM):

- Reason: Trump's support for traditional energy, especially oil and gas, could positively impact the entire fossil fuel sector.

- Action: We are slightly increasing our positions in these oil giants as they are already a key part of our portfolio and we believe their performance will be even stronger under the Trump administration.

- Copper companies (FCX and SCCO):

- Reason: Trump's support for domestic production and infrastructure has historically provided positive sentiment for copper-focused mining companies. This metal is critical in infrastructure projects and technology.

- Action: This would be a completely new position where we consider Freeport-McMoRan (FCX) and Southern Copper Corporation (SCCO) attractive options. Both companies are valued attractively, pay dividends, and their technicals look strong. We put them in the Balance portfolio in particular for steady growth potential.

- Bitcoin (BTC) via ETF:

- Reason: Trump has hinted that the U.S. might want to take a leading position in cryptocurrencies and promote Bitcoin as part of the innovation economy.

- Action: For the Futuro portfolio, we are considering embedding Bitcoin through a BTC ETF to take advantage of the potential legislative support and growth in the value of this asset over the long term.

- Tesla (TSLA):

- Rationale: Given Donald Trump's public support of Elon Musk, one would expect that Tesla could gain a more favorable market position due to more favorable government policies. Musk's involvement in politics could bring new opportunities for Tesla, such as deregulation or government contracts.

- Action: we are not worried about Tesla in the long term, and instead see positive potential for Musk to gain more influence. While there is a risk of weakening his focus with more involvement outside of Tesla, overall we expect his influence to be beneficial to Tesla.

Short-term volatility in favor of growth

This is a way to use short-term volatility to your advantage by leveraging positive sentiment in these sectors. After Trump's victory, these are the areas we expect to see favorable growth, and we plan to use it to increase the value of our portfolios.

As part of this strategy, we are prepared to gradually reduce exposure to certain positions over the coming months if the opportunity to exit with positive numbers arises. This approach provides us with the flexibility to adjust positions as the market environment evolves, while still benefiting from the potential of Trump's policies.

Kamala Harris' election strategy

We expect that the election of Kamala Harris would represent a continuation of the current policies of the Joe Biden administration, as Harris was part of that administration. No dramatic changes are likely, so we expect market reactions similar to those seen after Biden's election four years ago. We will focus on sectors and companies that may benefit from the positive sentiment associated with this policy, particularly within the Futuro portfolio where we are planning for trades within weeks and short-term opportunities.

- Renewables and Clean Energy (Plug Power and FuelCell Energy):

- Reason: Harris will likely support renewables and clean energy, as will the Biden administration. Companies like Plug Power and FuelCell Energy are focused on hydrogen power and fuel cells. Although they are not currently profitable for shareholders, they may benefit from positive sentiment and growth in demand for clean energy.

- Action: We are planning short-term trades in these companies within the Futuro portfolio. We will take advantage of the increase in their value driven by market sentiment, and we plan to gradually reduce these positions as prices evolve.

- Healthcare (CVS Health and Walgreens Boots Alliance - WBA):

- Rationale: With Harris going forward on Obamacare, which promises broader access to healthcare, we expect growth in the healthcare sector. CVS Health and Walgreens Boots Alliance (WBA), which we already hold in the portfolio, could benefit from positive market sentiment in the healthcare sector.

- ACTION: We will be increasing our position in WBA at CVS would be a new position, all due to their attractive valuation and growth potential. We plan to hold these positions over the medium term as long as the market shows positive sentiment in the healthcare sector.

- Technology and ESG (Alphabet/Google):

- Reason: Harris is likely to focus on supporting companies that meet high ESG standards and have a positive impact on the environment. Alphabet (Google), as a technology giant with a global reach and a strong commitment to ESG, has an advantage in this regard.

- Action: we plan to monitor sentiment and possibly increase positions in Google if a positive outlook emerges. Their strong focus on ESG could attract additional institutional investors, which should support share price appreciation.

- Renewable Energy (NextEra Energy - NEE):

- Reason: NextEra Energy is a leader in renewable energy, a sector that could get another boost under the Harris administration. The company is well diversified in solar and wind energy and has a strong market position.

- ACTION: We will consider new positions at NextEra Energy as a long-term investment that would benefit from the growing focus on green energy and government subsidies for renewables.

Should Kamala Harris prevail, our strategy would focus on short-term gains more within the Futuro portfolio, particularly in the renewable and healthcare sectors, to take advantage of positive sentiment. We also plan to monitor tech giants and green energy companies for potential longer-term investments.

Long-term approach and risk management

However, we do not plan to make dramatic changes to any of the portfolios; it is essentially about taking advantage of the short-term fluctuations we expect. In the long term, these choices should not significantly change our strategy or the substance of our portfolios. We also do not plan to engage in frantic trading - all our actions are deliberate, and we are focused on working with the available cash, which we currently have at 20%. We are not going to allocate all of this cash unless we feel a strong market reaction, and each position has predetermined entries and exits.

We view these events primarily as a chance to improve our overall return without adding unnecessary risk.

Disclaimer:

This article is provided for informational purposes only and should not be considered investment advice, a recommendation to buy or sell securities or any other financial products. The authors make no representations as to the accuracy, completeness or timeliness of the information contained in this article. Readers should consult a financial advisor or other professional if they need specific investment advice or if they have questions about their financial decisions. The authors of this article are not responsible for any loss or damage caused by the use of the information in this article. Past years' profits are no guarantee of future profits.